Five Reasons to Perform a Vendor Master Cleanse

September 10, 2019

How to Perform a Vendor Master Cleanse in Your Health System

October 25, 2019In today’s healthcare landscape, the government funds over two-thirds of all provider costs, totaling over $3.5 trillion annually. Generally, the Center for Medicare and Medicaid Services (CMS) manages the payment of these claims. In an effort to maintain integrity in the current healthcare system, providers are responsible for determining whether the submitted claims are paid correctly. If an overpayment is made, the provider must report and return the funds within 60 days of discovery. Overpayments can occur from duplicated claim submissions, payment for non-covered or excess services, payment to the incorrect individual, or any other misapplication of government funds.

31 U.S.C. § 3729(c): “[A]ny request or demand, whether under a contract or otherwise, for money or property which is made to a contractor, grantee, or other recipients if the United States government provides any portion of the money or property which is requested or demanded, or if the government will reimburse such contractor, grantee, or another recipient for any portion of the money or property which is requested or demanded.”

Mounting Liability Under the False Claims Act

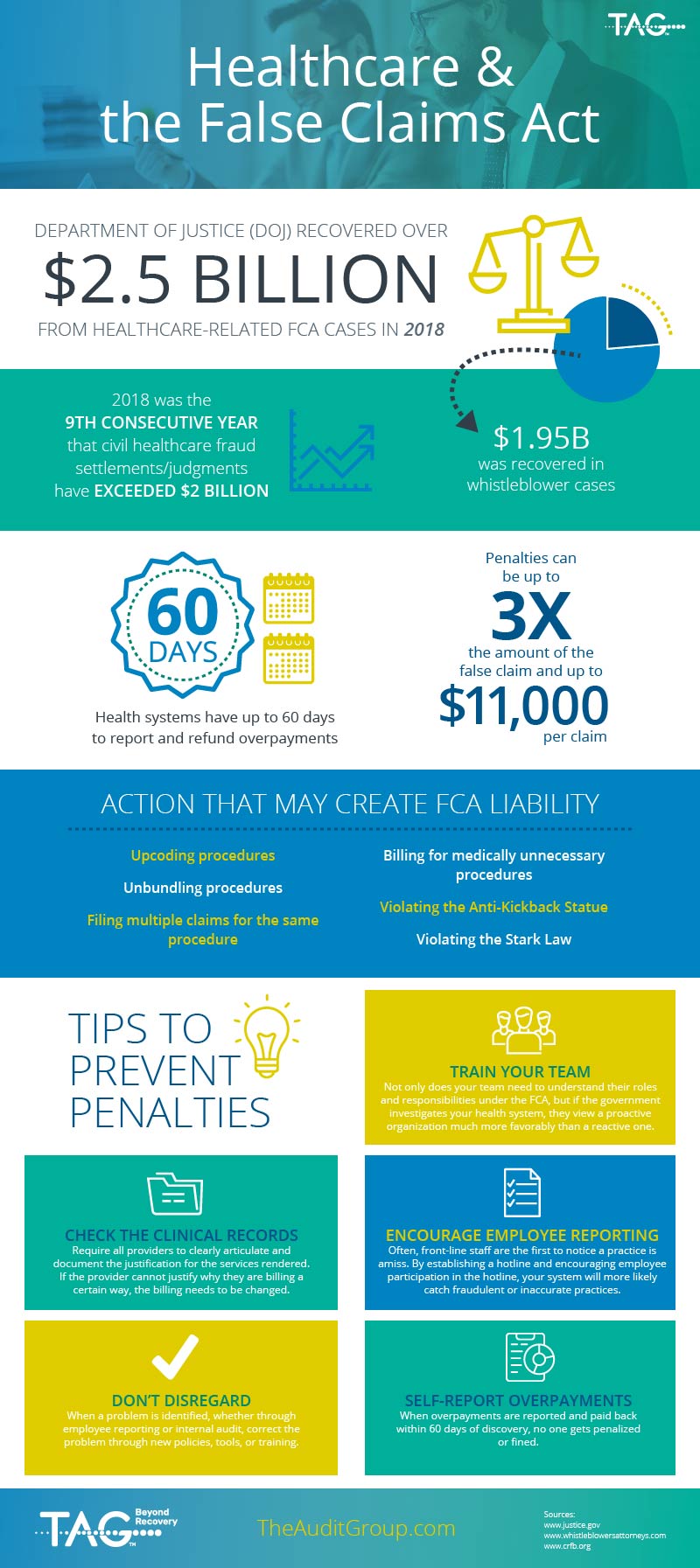

When healthcare providers fail to follow these requirements, they become subject to penalties under the False Claims Act (FCA). The FCA makes it a crime to knowingly falsify a claim to any federal health care program. Under the FCA, “knowingly” simply means having knowledge that the claim is false and not correcting it. Even if a provider or individual does not intend to defraud the government but knows some part of the claim is not correct, they are still liable under the FCA.

Penalties under the FCA can be steep – up to three times the amount of the false claim and up to an additional $11,000 per claim. For example, if a provider falsely submits a claim for $10,000, the penalty for that false submission could be $41,000.

In 2018, the Department of Justice (DOJ) recovered over $2.5 billion from healthcare-related FCA cases. Since the FCA’s adoption, it has triggered individual penalties of over $40 million for falsely billing medically unnecessary procedures.

One healthcare system delayed repaying overpayments for two years instead of complying with the 60-day deadline. The healthcare system wrongly withheld payment on over 400 claims, resulting in an almost $3 million dollar penalty, in addition to paying back the overpayments.

Preventing Penalties

How do you prevent penalties under the FCA? It all begins with taking steps toward prevention. Healthcare systems need to be on the lookout for potential FCA violations before they occur and work to immediately correct false claims that are submitted. Use these tips to take a proactive approach to prevention:

Train your Team

Not only does your team need to understand their roles and responsibilities under the FCA, but if the government investigates your health system, they view a proactive organization much more favorably than a reactive one. CMS cares greatly that its provider partners take the time to equip their staff to meet patient and regulatory needs.

Check the Clinical Records

Require all providers to clearly articulate and document the justification for the services rendered. If the provider cannot justify why they are billing a certain way, the billing needs to be changed. Additionally, providers should make limited or no changes to records after submission.

Encourage Employee Reporting

Often, the front-line staff is the first to notice a practice is amiss. By establishing a hotline and encouraging employee participation in the hotline, your system will be more likely to catch fraudulent or inaccurate practices.

Don’t Disregard

When a problem is identified, whether through employee reporting or internal audit, correct the problem through new policies, tools, or training. In the event of an audit, the government will appreciate your system’s commitment to ensuring compliance. Your health system can partner with a third-party consultant, like TAG, Inc. to identify ways to improve existing policies and train your staff as needed.

Self-Report Overpayments

When overpayments are reported and paid back within 60 days of discovery, no one gets penalized or fined. It is always in your system’s best interest to be transparent and honest when overpayments occur.

By working proactively, your healthcare system can prevent being trapped under FCA liability. Though it requires consistent effort to comply with the FCA, the effort pays for itself by avoiding the steep penalties and increased scrutiny.

Turn to TAG to take full advantage of these tips and create new procedures so your health system stays compliant with the False Claims Act. Contact us now.