Manufacturing medical devices in the US is $47B a year industry with implantable devices accounting for $26.75B. With revenue values this high accounting for essential life-saving equipment, it is important for healthcare system leaders to understand the true or total cost of ownership. This not only means the original purchase of the devices but also takes into account equipment warranties. Afterall, warranties exist to mitigate the risks related to ownership and help create vendor reliability.

However, the healthcare industry as a whole continues to struggle to manage their warranties, especially when it comes to implantable devices. Getting greater insight into the complexities of managing these warranties takes your organization one step closer to cutting costs around explants by using available credits.

Understanding Medical Device Credits

Medical devices implanted in the body are purchased with a warranty that guarantees the device’s expected efficacy, functionality, and safety of the implant. If there is a recall or failure of any particular part of the device it may be eligible for a return or replacement. If the item is sent back to the manufacturer and all of the warranty requirements met, a credit or replacement product will be issued back to the hospital that conducted the surgery for either all or a prorated amount of the original cost of the device.

What is an Implantable Device?

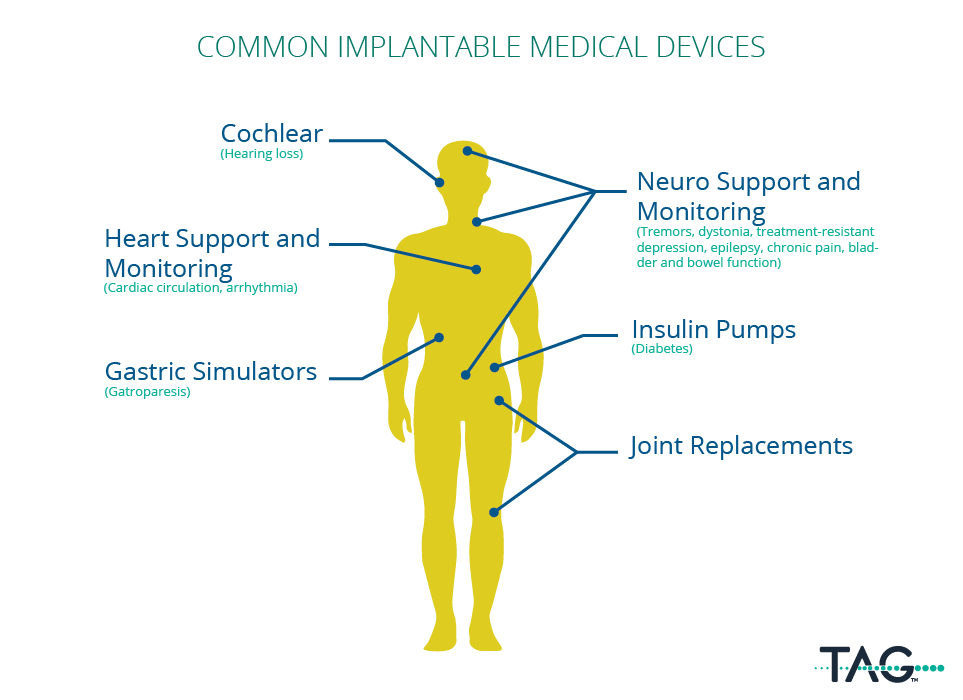

Any devices that are surgically implanted into the patient with the intention of it remaining inside the patient after being discharged. The most common types of implanted devices are cardiac and neuro monitoring, organ support, joint and limb replacements, organ support, and cochlear.

Also referred to as explant devices.

Why are explant warranties a topic of discussion?

Outside of patient safety and satisfaction, there are two significant financial implications of properly utilizing medical device warranties. The first having to do with receiving funds back to a hospital\’s bottom line for faulty products (the credit). The second related to proper reporting of the reduction of the cost of the procedure back to the Center for Medicare and Medicaid Services (CMS). If not reported accurately, the clinician or entity conducting the procedure will have been overpaid if the credit was not have been reported resulting in substantial fines (as high as $22,927 per instance plus three times the value of the credit in question), negative press, and ultimately prompt repayment if an audit was later performed.

All eligible explanted medical devices should be pursued for warranty credit or free replacement and subsequently reported to CMS if the amount of the credit exceeds 50 percent of the original cost of the device. This is known as the 50% rule. Credit amounts greater than or equal to 50 percent are due back to Medicare, all other instances are additional revenue for the health care provider as they do not need to be reported.

Why are these warranties under scrutiny?

The Office of Inspector General (OIG) conducted studies that uncovered health systems were not always complying with Medicare requirements for reporting credits related to explants leading to robust auditing on medical device warranties.

To conduct the audit, the OIG obtained a list of warranty credits from two device manufacturers issued to hospitals for years 2008 through 2013 for five cardiac medical devices that had been recalled or had high failure rates.

They did not contact the hospitals to verify receipt of the credits reported by the manufacturers. From this list, they matched the names and Social Security numbers of the device recipients to the Medicare Enrollment Database and identified 3,336 Medicare beneficiaries who had these devices implanted. Using the warranty credit data and the CMS National Claims History file, they subsequently identified 2,986 claims that had a cardiac device replacement procedure for these beneficiaries. They excluded 2,690 of these claims because they did not meet the payment reduction criteria for replaced medical devices, such as being a device-intensive procedure or having received a credit of 50 percent or greater. We reviewed the remaining 296 claims for which 210 hospitals billed for a device-intensive procedure and were issued a credit of 50 percent or greater. We considered these 296 claims at risk for overpayment because these claims also did not include the required value code or modifier.

The report showed a review of 296 payments for procedures where a recalled medical device took place and found that hospitals did not comply with Medicare requirements. Medicare contractors paid hospitals 7.7 million for cardiac device replacement claims rather than 3.3 million, resulting in overpayments of $4.4 million. All of which is now expected to be paid back within 60 days as required under the 60-day rule.

Challenges and Ownership of Explant Devices

The process for reporting medical device credits on Medicare claims involves coordination across several hospital departments, predominately; Clinicians, Supply Chain, IT, Accounts Payable, and Patient Accounting to properly account for the warranty credit.

Different departments are responsible for contacting the manufacturer, monitoring the eligibility and issuance of the credit, and determining whether an adjustment claim needs to be submitted to pass along the credit to Medicare. It is the responsibility of the Hospital to have the credit issued, it cannot be assumed that the manufacturer will take care of this process without the hospital\’s initiation and oversight. To further complicate, each manufacturer may have a unique process and require different documentation for the return of a medical device where a warranty credit is expected, which may fall outside of the typical returned goods process. Furthermore, hospital staff submitting Medicare claims must be aware of credits that are at least 50 percent of the price the facility paid for the replacement device, and staff must report the credit as a deduction on a submitted claim.

When billing for the device replaces procedure a hospital may not know how much credit will be issued for, if at all. In these situations, the hospital has two options. First, the hospital may hold the claim until a determination is made about the credit and then submit the claim with the appropriate condition code6 and value code7 or modifier8 if it receives a reportable credit. Second, the hospital may submit the claim immediately without a condition code and value code or modifier and, if the hospital receives a reportable credit later, submit an adjustment claim with the appropriate condition code and value code or modifier.

Often hospitals have inadequate policies and controls in place to report these device warranty credits. Hospitals contribute their incorrect billings to a lack of policies and procedures for reporting manufacturer credits, lack of knowledge of warranties, and credit availability.

Tips to Proactively Manage Medical Device Warranties

- Clinicians should be proactive and initiate a return for all devices that could possibly be eligible for warranty credit. Let the manufacturer be responsible for accepting or rejecting the claim.

- Supply Chain must follow the path provided by each manufacturer for returning faulty medical devices. Do not “hand” products to the sales rep or submit through any other incorrect channel, RMA numbers must be generated and tracked.

- Supply Chain needs to ensure all of the necessary paperwork is completed by the clinician and submitted to the manufacturer as part of the return to ensure the claim is processed expeditiously.

- Supply Chain must track the RMA number in the ERP system.

- Accounts Payable should receive the credit memo during normal business operations with the manufacturer.

- Accounts Payable must process the credit and route all explant credits to the appropriate person(s) in Materials Management and Patient Accounting who can also provide General Ledger detail as needed.

- Supply Chain and Patient Accounting should determine if the credit is worth more than 50 percent for the replacement device.

- Patient Accounting needs to report the credit as a deduction on the patient\’s claim if the credit meets the minimum requirements.

- Supply Chain must ensure that all credits are sent to Accounts Payable if not already received.

TAG Tips

- Assign a team within each hospital that can consistently package and ship the explants.

- Develop a detailed process to clear up any confusion or ambiguities (such as job aids, checklists, and workflows).

- Improve awareness and education within the hospital with visual reminders of the proper process and steps.

- Create a pop-up in the electronic health record (EHR) to flag if the credit vs replacement cost is subject to the 50% rule.

- Maintain a centralized record of all explant activity tracing data such as; what was explanted, the reason for explant, shipping info, the credit outcome and amount, and the associated patient claim activity.Hospitals that fail to take preventive action may find themselves the subject of a future OIG or CMS audit. Prompt attention to these requirements may help limit exposure to overpayment demands and False Claims Acts Liability.Need help reviewing your medical device credits? We\’re here to help. Our Explant Credit Recovery services review your transactions and warranty information. Our team then works with the manufacturers to ensure your healthcare system received the credit you are owed. Reach out now to learn more.