TAG Inc. Wins 2 Globee® Awards in the 6th Annual 2021 American Best in Business Awards

July 16, 2021

Managing your Health System’s 1099 Vendors

August 17, 2021Top AP KPIs

Invoice Cycle Time

Invoice Cycle Time must be monitored and closely managed to avoid late payment penalties and allow the health system to take full advantage of all prompt pay discounts.

Invoice Cycle Time is the time that it takes between a vendor issuing an invoice and the vendor receiving payment for that invoice.

Depending on your health system’s cash flow strategy, AP should aim to lower their invoice cycle time to receive the discounts and prevent unnecessary late fees or credit holds. AP leaders should work with accounting leaders to determine the best payment strategy for their organization.

Invoice cycle time can be broken down into three additional metrics to monitor and manage:

- Time for invoice issuance to receipt

- Time from receipt to processing: Health systems should aim for a time period of 5-15 days before an invoice is entered into the ERP system.

- Time from processing to payment: Ensure you are considering the time it takes for the vendor to receive payment based on the payment method used. Add this to the total invoice cycle time when making prompt pay discounts.

Payment Errors

Payment errors result in direct financial loss to your health system by funds sent in error, excess funds paid to vendors, savings not realized, and time lost spent researching and resolving these errors.

the number of payments processed by AP that contained an error

÷

the total number of transactions initiated over the same period of time

- Payment made to the wrong vendor

- Data Entry Error

- Processing an Invoice Multiple Times

the number of duplicate payments over a certain period of time

÷

divided it by the total number of invoices paid over that time period

Frequent payment errors also lead to estranged relationships with vendors leading to a risk of losing preferred credit terms.

Percent of Vendor Discounts Captured

Vendors often offer discounts such as prompt pay discounts and discounts when using their preferred payment methods. AP and Supply Chain leaders should monitor the percent of their vendor discounts captured to see where they can further save by taking advantage of more discounts available.

The best way to have a total look at this KPI is to audit the organization’s contract and payment data to ensure compliancy to terms and identify any instances where discounts were earned, but not deducted. Then the AP team should reach out to their vendors to retroactively recover the funds owed to them.

While tracking this KPI, leaders can also make it a goal to track the reasons the discounts were not captured to better understand their operations and where errors are occurring such as:

- Payment processing taking too long

- Vendors terms not set up correctly in the system

- High number of exceptions or invoice holds causing prolonged payment processing

Days Payable Outstanding (DPO)

Days Payable Outstanding (DPO) represents the average number of days it takes for a hospital or health system to pay back its accounts payable. By tracking and managing toward an optimal DPO, AP can ensure they are positively managing their vendor relationships and reducing the amount of late fees the health system incurs.

When a health system fails to pay an invoice within the contracted terms, suppliers often resubmit invoices that are past due for payment. Past due invoices can further open your organization up to the risk of duplicate payments since there are now two invoices working through the process.

How to Calculate DPO Ratio:

1. Determine the Average Accounts Payable:

Avg Accounts Payable =(Beginning Accounts Payable – Ending Accounts Payable for a set time period) ÷ 2

2. Calculate DPO:

DPO =(Avg Accounts Payable / Cost of Goods Sold) x Number of Days in the Accounting Period

A high DPO indicates that a health system is paying their vendors too late and could result in increased payment terms and lower credit ratings. On the contrary a DPO that is too low may indicate that the organization is not taking full advantage of their credit terms and cash flow options. Working with the accounting team is essential to uncover the best DPO ratio as it is an indicator of healthy cash flow management.

Cost to Process a Single Invoice

This KPI reflects directly on the productivity of the AP team. The cost to process each invoice KPI includes all aspects of AP processing including but not limited to:

- AP staff expenditures

- Operating expenses

- Systems and equipment

- Overpayments, errors, and late payment fees

- Vendor charges

- Office supplies

- Audit costs

To measure this KPI, take the AP department’s total expenditures and divide that by the total number of invoices processed for the same time period.

Payment errors, team member performance, discounts captured, technology utilization, and fees mitigated all play important roles in keeping this cost as low as possible.

Top Payment Methods

Tracking and monitoring the payment methods your organization uses to pay its vendors can help save on funds and efficiencies. Health systems should move toward a full (or as cloose to full as possible) electronic payment system to streamline processes and easily track cash flow. However, most healthcare organizations still find themselves making a significant (over 50%) number of payments by paper check costing additional time to process invoices.

While tracking the top payment methods, organizations must also measure their preferred payment KPI – electronic vs non-electronic payments - to other forms of payment such as check or credit card.

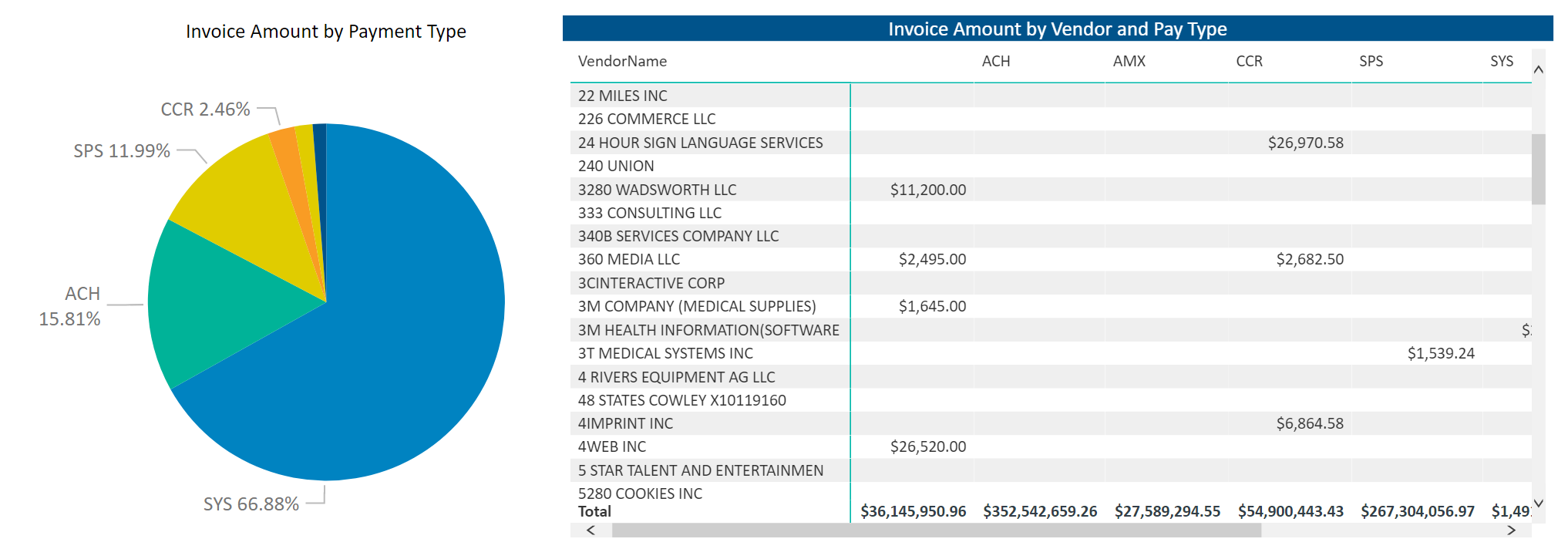

Payment Types Data Visualization Dashboard from TAG Inc.

Average Time to Approve Invoices

Track the average time it takes to approve invoices for payment. Take it a step further and break this time down to track each step of the process:

- Data entry

- Routing

- Approval

- Exceptions Management (work with Supply Chain to accurately capture this information)

It is essential to reduce a health system’s approval time to increase the discounts captured rate and avoid late fees. Additionally, adjusting approval processes, thresholds, and match rules can reduce the number of approvals and exceptions requiring human intervention.

Invoice Exception Rate

Exceptions occur when a problem arises on an invoice such as an invoice awaiting approval or routing errors, often resulting in duplicate payments or other errors. Exceptions can halt the payment process due to manual steps needed to resolve the exception and occur due to purchase order (PO) and invoice discrepancies, missing or incorrect information, and bottlenecks in the approval process.

Exceptions can cause overpayments, resource draining time hang-ups, and degradation of vendor relationships.

TAG can help your health system visualize its AP KPIs and more with customizable dashboards for your specific needs. Reach out today to learn more.